Incentives

Objectives

The Lindale Economic Development Corporation (Lindale EDC) and the City of Lindale are committed to enhancing and expanding the local economy. Together we strive to be a catalyst for high-quality commercial and industrial development in all parts of the community.

The primary purpose of the Lindale EDC is to assist in the creation of new primary jobs and the attraction of new capital investment. A secondary purpose is to provide infrastructure assistance to commercial developers planning large-scale projects in Lindale. The Lindale EDC provides complete and confidential site location services free of charge to its clients.

Regional Approach

Lindale enjoys an excellent relationship in our regional economic development area with the City of Tyler and works cooperatively work on securing incentives for clients.

Incentives

Economic development incentives help firms make investment decisions based on reduced cost and increased profitability. Incentive programs can generate long-term benefit to communities by lowering unemployment and increasing annual earnings.

Development incentives are negotiated on a case-by-case basis to assist eligible companies to expand or locate to the Lindale area.

Incentive packages can be provided individually or jointly by the Lindale EDC, the City of Lindale, and/or the Tyler Economic Development Council, which serves all of Smith County. The availability and size of any incentive is determined by several factors including number of new jobs created, new capital value, level of pay and benefits of full-time employees, whether the business is a targeted industry, or a community/board support of the incentive.

The following economic development tools are available for selected projects:

Local Incentive Programs

Tax Abatement

A common economic development tool that can defer property taxes on new plant and equipment expenditures for expanding companies. The City of Lindale will, on a case-by-case basis, give consideration to providing tax abatement on a portion of real and personal property as stimulation for economic development. All projects are subject to the qualifications, conditions and requirements to be fully described within an agreement and subject to the approval of the Lindale City Council. May not be offered within the TIF Zone.

Eligible Projects:

- Manufacturing Facilities

- Distribution Facilities

- Corporate Offices

- Research Parks

- Major Tourism Attractions

Minimum Requirements for Eligibility:

- $1 million in capital investment or

- Annual payroll increase of $400,000 or

- 25 new permanent full time jobs

Download Incentive Application

Economic Development Grants and Loans (Chapter 380 Contracts)

Chapter 380 of the State of Texas Local Government Code allows municipalities to making loans and grants to stimulate business and commercial activity in the City. The City of Lindale is open to consideration of Chapter 380 agreements. All eligibility requirements must follow tax abatement policy requirements.

Download Incentive Application

Triple Freeport Exemption

The Freeport Exemption exempts certain types of tangible personal property (i.e., inventory) from ad valorem (property) taxation provided the property is:

- Acquired in or imported into Texas to be forwarded out of state

- Detained in Texas for assembling, storing, manufacturing, processing, or fabricating purposes by the person who acquired or imported it

- Transported out of state within 175 days after the date the person acquired or imported it into Texas.

Because oil, natural gas and other petroleum products are not considered freeport goods, they are not eligible for the exemption and therefore remain taxable. Even when goods are sold to an in-state purchaser rather than shipped out of the state, they may qualify for the Freeport exemption. However, the property must qualify under the above requirements as Freeport property, and must be transported out of the state within 175 days after it was first acquired in or imported into the state.

Application for Exemption of Goods-In-Transit

Tax Increment Financing

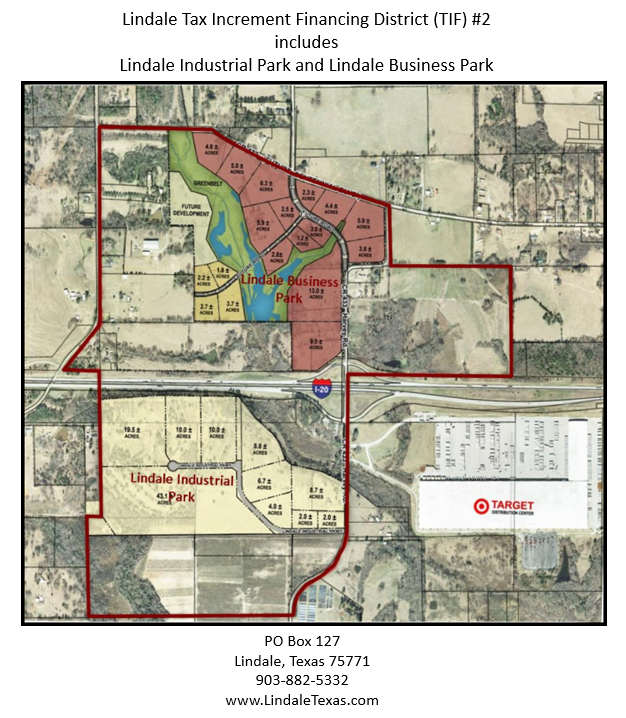

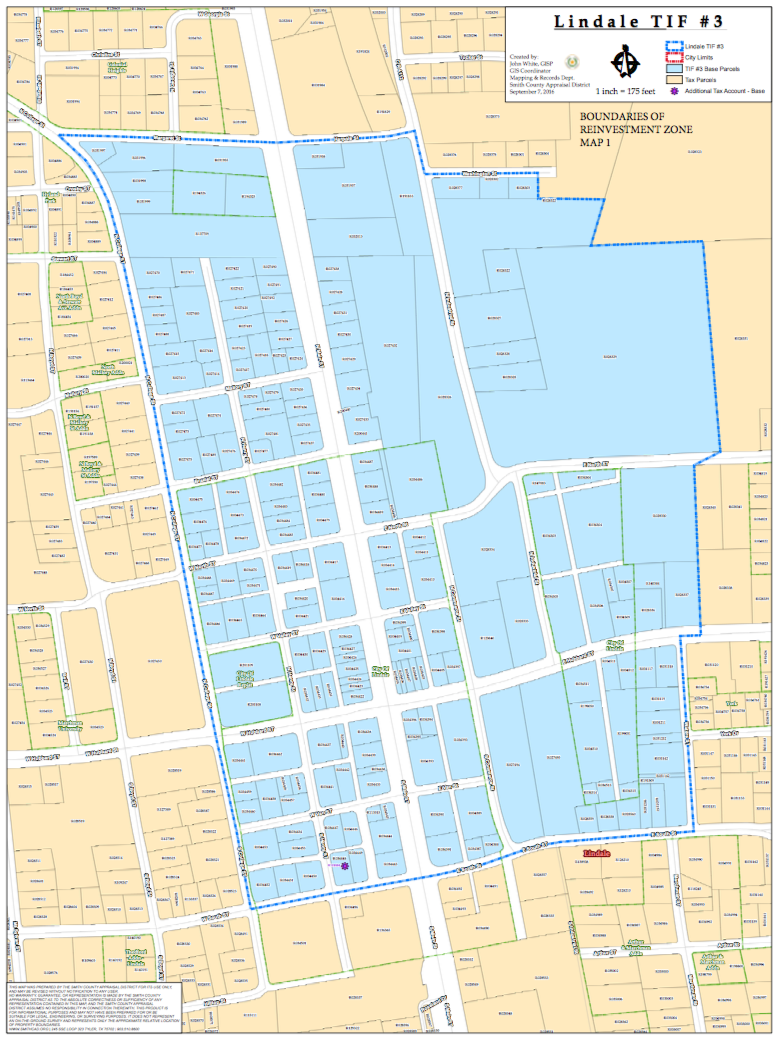

The City of Lindale and all eligible taxing entities have formed the Tax Increment Financing Reinvestment Zone #2 (TIF) which covers 263 acres north and south of I-20 near Harvey Road (CR 433). The area includes the Lindale Industrial Park and Lindale Business Park and surrounding properties. TIF #3 covers the downtown Lindale area. The TIF Board will consider using the TIF to finance needed public infrastructure improvements in the Zone. Improvements can be paid for by the TIF then repaid by the taxes generated by the development, or could be paid upfront by a developer, then repaid to the developer through taxes generated by the developer.

Community Based Assistance

Possible Community Based Assistance could include:

- Relocation assisance for key personnel

- Job fairs to attract employees

- Residential real estate assistance (non-financial)

- Community orientation, introductions and tours

- Media-worthy ground breaking event

- Identification of business support services

Smith County Revolving Loan Fund (SCRLF)

The Tyler EDC manages the Smith County Revolving Loan Fund, which provides loans to firms that create or retain permanent jobs through the retention, expansion, or establishment of companies in Smith County.

Eligible Applicants:

- Businesses located or locating in Smith County that are producing a product or providing a service from which a majority of their sales are derived outside of Smith County. The company should also provide evidence of a financing gap and should have a substantial potential for retention or creation of jobs.

Eligible uses:

- Working capital

- Purchase of equipment and machinery

- Development of land and building

- Pollution control abatement

Ineligible uses:

- Speculative activities

- Loans which assist the relocation of jobs from another labor area

- Investment

- Refinancing

- To provide the equity contribution required for federal loan programs

Loan Particulars:

- Maximum loan amount is $200,000

- Minimum loan is normally $50,000

- Loan ration will be at least two private dollars to one SCRLF dollar

- Private-sector dollars include private financing from other lenders or equity investment

- Owner participation will generally be 20% of the total project costs

- The loan may be subordinated to the primary lender or funding source

- Interest rate will normally be fixed and at or slightly higher than the national prime rate

- Loan term will be tied to the life of the assets financed, up to 25 years

- Working capital loans shall be for five years or less

State Incentive Programs

Texas Enterprise Fund

Commonly known as the state’s deal closing fund, the Texas Enterprise Fund (TEF) continues to attract businesses and jobs to Texas. The TEF can be used for a variety of economic development projects, including infrastructure development, community development, job training programs and business incentives.

Projects that are considered for the Enterprise Fund support must demonstrate a project’s worthiness, maximize the benefits to the State of Texas and realize a significant rate of return of the public dollars being used for the economic development of Texas. Capital investment, job creation, wages generated, financial strength of the applicant, applicant’s business history, analysis of the relevant business sector, and federal and local government and private sector financial support of a project will all be significant factors in approving the use of the Enterprise Fund.

Applications for the TEF must be submitted to the Office of the Governor, Economic Development & Tourism Division, which provides information on how funds are to be utilized and how the proposed project meets the criteria of the program.

Texas Enterprise Fund Overview

Skills Development Fund

This state level program assists community and technical colleges in financing customized job training for local businesses. Average training costs are $1,000 per trainee. This fund successfully merges business needs and local job-training opportunities into a winning formula for putting people to work. The Fund will provide training for specific skills for workers who will be hired by the businesses. The program is managed by the Texas Workforce Commission, and the application process starts with Tyler Junior College West Campus Office of Continuing Education.

Skills Development Fund Overview

Texas Enterprise Zone Program

Texas Enterprise Zone Program (TEZP) approved projects are eligible to apply for state sales and use tax refunds on qualified expenditures. The level and amount of refund is related to the capital investment and jobs created at the qualified business site. The Lindale EDC will file the TEZP application while the company completes portions of the application requirements as needed.

Texas Enterprise Zone Program Overview

SBA 502 Loan Program

Businesses that are located in or are interested in locating in Lindale have access to the Small Business Administration's 504 Loan Program through the Tyler based, Greater Texas Capital Corporation. The 504 Certified Development Company (CDC) Program provides growing businesses with long-term, fixed-rate financing for major fixed assets, such as land and buildings.

Typically, a 504 project includes a loan secured with a senior lien from a private-sector lender covering up to 50% of the project cost, a loan secured with a junior lien from the CDC (backed by a 100% SBA-guaranteed debenture) covering up to 40% of the cost, and a contribution of at least 10% equity from the small business being helped. The maximum SBA debenture is $1 million for meeting the job creation criteria or a community development goal. Generally, a business must create or retain one job for every $35,000 provided by the SBA. The maximum SBA debenture is $1.3 million for meeting a public policy goal.

Small Business Loan Program Overview

Incentives Disclaimer

Please note that incentives are not offered for every project. Incentives typically require approval from one or more boards or commissions. The Lindale Economic Development Corporation (LEDC) and the City of Lindale will work with each applicant to determine the specific needs of the applicant and tailor an incentive package to that company's particular needs.